Retirement savings for seniors can be much more complex than you ever imagined, and it can seem that there just isn’t any money left at the end of the month. Even if you have already cut out the morning trip to Starbucks and stay home much more than you go out you may still be wondering how to stretch your retirement money.

Take heart, because there are ways you can successfully reduce your monthly budget and save on hundreds of expenses by taking advantage of some of these money saving tips.

The editorial content on this page is not provided by any of the companies mentioned, and has not been reviewed, approved or otherwise

endorsed by any of these entities. Opinions expressed here are the author’s alone including the advertising disclosure.

1. Use “Cash Back” Credit Cards.

Cash-back credit cards are prevalent for a valid reason: They pay you back a portion of what you spend on your regular purchases.

Regardless of whether you utilize your card frequently for gas, shopping, eating out, or a blend of every one of the three to say the least, there’s a cash-back credit card out there that will enable you to increase the cash you get back in your pocket for your everyday purchases.

Click Here for a List of Cash-Back Credit Cards!

2. Save on Home Repair Expenses.

Seniors can be taken by surprise with home repairs and those unexpected repair bills.

A home warranty can help you repair or replace home appliances and systems. This will eliminate unplanned expenses that you did not count on, and will save you tons of money in the long run. Before you buy, find out what’s covered and what the warranty provides. There may be exclusions and limitations. Learn who will perform the repair work. Also, find out if you can cancel the policy, and whether there is a period — such as 30 days — when you can get a “free look” at the program.

Click to Get a FREE MONTH and $50 Credit on Senior Home Repair Plans

3. Save on Auto Repair.

Consider purchasing an extended auto warranty if your auto warranty has expired or is about to expire.

Your car is the most expensive thing you will own other than your home. The dealer will often provide a warranty for the first 3-4 years, but after that, you are completely unprotected. We all know auto repairs cost a lot of money especially since shops charge as much as $175/hour just for labor. That is why it is recommended that all drivers get an Auto Warranty to protect against such costly repairs for the life of your vehicle. Let Complete Car Warranty help you save money today!

Click Here For 60% OFF Dealer Prices and Save Thousands on Your Auto Repair

4. Get 30 Days Free and 5% Cash Back with Amazon Prime.

Amazon Prime provides many benefits that save you money and time.

Members receive benefits which include FREE fast shipping for eligible purchases, streaming of movies, TV shows and music, exclusive shopping deals and selection, unlimited reading, and more. Here is a list of some of the benefits you get by using Prime:

- FREE Two-Day Shipping: on eligible items to addresses in the contiguous U.S. and other shipping benefits.

- Prime Video: unlimited streaming of movies and TV episodes

- Prime Music: unlimited, ad-free access to hundreds of Prime Playlists and more than two million songs

- 5% Cash Back from Whole Foods Market: Exclusive savings for Prime members, 5% back for eligible Prime members with the Amazon Prime Rewards Visa Card

- Deals and Discounts, Compliments of Amazon Family: These include up to 20% off diapers, baby food, and more through Subscribe & Save

- Prime Reading: You can borrow books, magazines, and more from the Prime Reading catalog and read them on your Fire tablet

- And much more…

Click Here for 5% Cash Back and 30 Day FREE With Amazon Prime!

5. Earn With Travel Rewards Credit Cards.

Nobody needs to spend their well deserved cash on things like additional travel fees. We believe it’s easy to assume that most people would rather spend that cash on things like a group excursion or a guided tour through some historic faraway land instead.

When interested in a travel rewards charge card, there are two kinds of cards to consider: those that offer rewards in a program managed by the card issuer, and those that offer points or miles with a travel provider, such as airline and hotel credit cards.

Both card types offer rewards that can be utilized toward travel or recovered for cash or statement credits, but the perks, points, and redemption offers will vary card to card. Generally, with partner rewards cards, your points will be held in your frequent flyer account. Alternatively, with program-operated cards you’ll be awarded either transferable points and fixed valued points.

The following website provides detailed information about different types of travel reward cards and how you can apply for a card that is right for you.

Click Here To Compare Travel Rewards Credit Cards

6. Get up to $3,900/yr Savings On Your Mortgage.

Mortgage rates are going up but the good new is that there is a new government program called HARP designed to save you thousands of dollars.

HARP is a government sponsored program that allows eligible homeowners to refinance even if they have little to no equity. Take advantage of historically low rates today with HARP and find out if you qualify.

Click Here to Save Thousands With HARP on Your Mortgage!

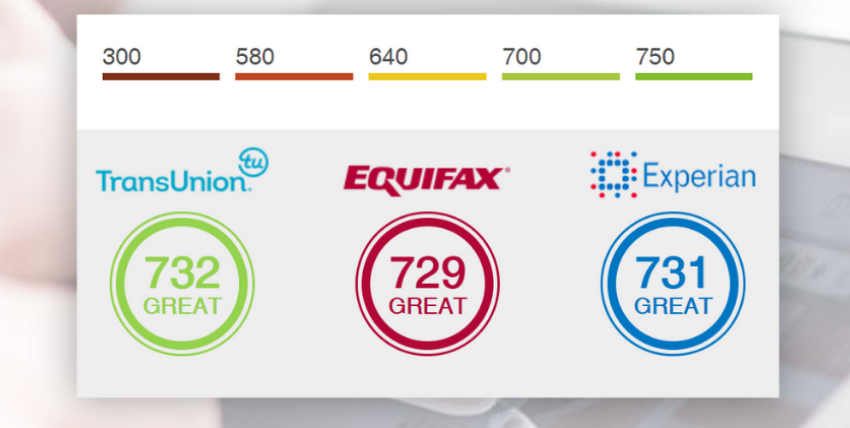

7. Get Fraud Protection with Credit Monitoring.

Even though most anyone can be a target of fraud and identity theft, senior identity theft is on the rise and those ages 50+ are often in the cross-hairs of scammers.

This is why you should keep an eye on your financial activity and credit report. Older people are great targets for scammers, especially their money and other assets. With more and more seniors getting online, not only are they at risk for mail and telemarketing scams, but they are also targets for email scams.

We’ve found a way for you get your credit score for FREE and your credit report for just $1. This monitoring service can help you against fraud and combat this growing epidemic.

Click Here to Get Your FREE Credit Score and $1 Credit Report Now!

8. Medigap Insurance Protects You From Unexpected Healthcare Costs.

Save on Costs that Medicare Doesn’t Cover

Millions of Americans rely on Medicare to help them with their basic healthcare needs in retirement. Yet Medicare doesn’t cover everything, and even when it does cover a certain service, it often doesn’t pay for 100% of its costs. As a result, you should look to get supplemental insurance coverage in the form of a Medigap plan in order to help pay for the additional costs not covered by Medicare.

Save on Healthcare Costs with $0 Deductible Medigap Insurance

9. Seniors Get a Discount at Walgreens.

Walgreens mission is to be America’s most-loved pharmacy-led health, well-being and beauty retailer.

With stores located within five miles of 75 percent of Americans, and with popular online offerings and an award-winning mobile app, Walgreens interacts with 8 million customers a day. Whether it is for a prescription, last-minute grocery or gift needs, photo prints or beauty products, Walgreens helps customers quickly get in and get what they want with ultimate convenience, often finding an unexpected shopping need to fill along the way.

Click Here to Get 20% Off Your Online Purchase at Walgreens!

10. Senior Dental & Vision Discount.

Make sure you’re protected during a time you may need it most.

Senior citizens across the U.S. are seeking coverage to aid in reducing their dental expenditures. Teeth, like bones, can soften as time passes and grow significantly more susceptible to degeneration and breakage. This can mean that seniors are often in need of more oral care than younger Americans, as they deal with broken teeth, loosened implants, gum problems, or other issues.

Click Here to Save Hundreds on Dental and Vision Coverage

11. Seniors Get Chronic Pain Medicine at Zero Cost To You.

If you have severe pain (like most of us do!), try a non prescription medication pain cream at zero out of pocket costs covered by most insurance.

The American Pain and Mobility Institute has is providing and effective alternative to prescription pain medication. Transdermals or Compounds are that answer!! By combining FDA approved ingredients, the ever evolving field of pain management has moved towards more targeted delivery medications, specifically those with a localized effect. “If you have pain…and want relief…you should be most certainly be using compounded medication for that relief.” Types of pain this medication can relieve are

- Arthritis

- Tendonitis

- Plantar Fascitis

- Epicondylitis

- TMJ

- Myofascial Pain

- Phantom-Limb Pain

- and much more…

Get Your Pain Cream at No Cost Covered By Most Insurance!

12. Get Internet Security at a Discount.

Norton Security provides PC backup and family safety for you and the people your family. 100% guarantee: From the moment you subscribe, a Norton expert is available to help keep your devices virus-free, or give you a refund.

Benefits include:

Provides real-time protection against existing and emerging malware including ransomware and viruses.Advanced security helps protect your private and financial information when you go online. Provides tools to help your kids safely explore the Internet. Offers 25 GB of secure PC cloud backup, providing additional protection against ransomware.

Alerts you about risky Android apps before you download them, with award-winning technology.

Get Norton Security Protection at a Discount

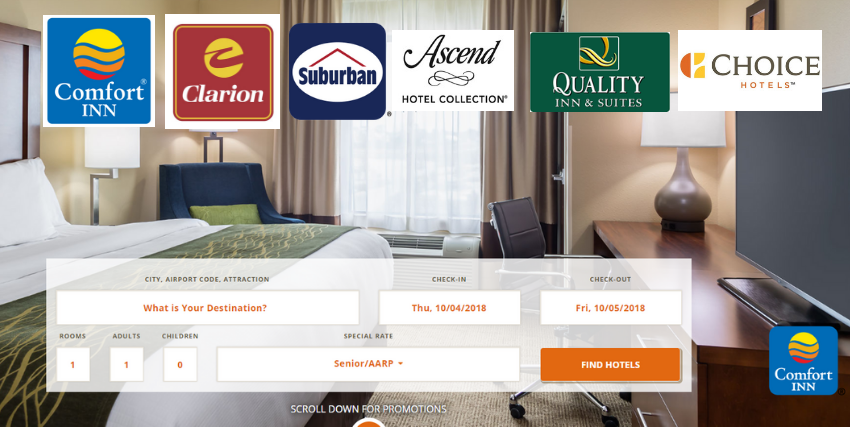

13. Get Extra Savings at Hotels.

Choice Hotels offers seniors an additional discount at all their locations including Comfort Inn, Clarion, Suburban, Ascend, Quality Inn, and many more.

Whether you are seeking leisure or family hotels, in the U.S. or around the globe, with more than 6,800 hotels in over 35 countries and territories our hotels are never far from where you need to be. You can always count on Choice hotels for a warm welcome and real value, includin benefits such as: LOWEST PRICE GUARANTEE, OVER 6,800 LOCATIONS, and ROOM TO BE GREEN.

Click here to check room rates at any of the Choice Hotels!

14. Get Free Benefits for Housing, Utility Bills, Home Improvement and More.

Billions in Assistance is Available! Get your share!

Learn More About Government Assistance For Seniors. This Resource Provides Information and Guidance on the Following:

- Information on Your State Benefit Programs

- How to Successfully Apply For Housing Grants

- Programs for Housing, Utilities, Home Improvement and More

- Information on Rental Housing Assistance

Click Here to Locate Your Benefit & Assistance Program Information

15. MedicarePlus Card – Free Prescription, Dental, and Vision Savings Card.

Start Saving Up to 75% OFF on healthcare services NOT covered by Medicare

Medicare World is the nation’s largest non-government resource for information and tools for those on Medicare. Medicare World created the Medicare Plus Card to appeal to the lifestyle needs of those living on Medicare. Since Medicare only covers so much, the Medicare Plus Card is intended to help provide substantial savings on items that most Americans have to pay out of pocket for. This includes healthcare expenses like prescription drugs, dental care, hearing care, and vision care, as well as non-healthcare products and services.

Get Your FREE MediCarePlus Card Now!

16. Get a 0% APR Credit Card to Reduce Your Monthly Payments

17. Seniors Save on Dietary Supplements at the Vitamin Shoppe

18. Get a Short Term Loan to Pay for Expenses

19. Refinance Your Car and Reduce Your Monthly Payments

20. Save on Auto Service and Parts with Pep Boys

21. Travel and City Attraction Tours by CityPASS with a Senior Discount

22. Protect Yourself When Traveling. Save on Travel Insurance with Allianz Travel

23. Get Discounted Rental Cars from FOX Rentals

24. File Your Taxes for Less. Save with eFile Tax Filing

25. Lose Weight With the Medifast Flex plan with a 30% Discount

26. Save on Your Medical Supplies from Myku Medical

27. Book from Sandals & Beaches Resorts and Save up to 65% on Your Next Vacation

28. Get Deals on Travel, Entertainment, Home Goods, and Much More

29. Get 100’s More Senior Discounts at Retirees.io!

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.